Extension Granted to Abhay Yojana Amnesty

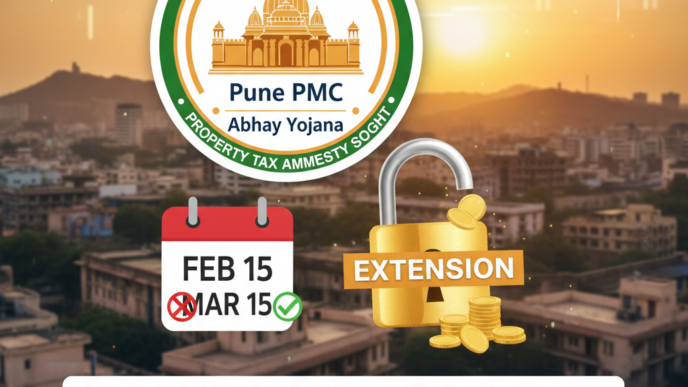

Pune Municipal Corporation (PMC) has officially approved a one‑month extension of the Abhay Yojana property tax amnesty, pushing the final deadline from 31 January 2026 to 28 February 2026. The decision, announced by the standing committee after a marathon session of deliberations, aims to provide a last‑minute relief window for thousands of households that have either missed the original cut‑off or are still grappling with penalty‑free payments. Municipal officials confirmed that the extension will apply to all eligible property owners across the 150 wards, irrespective of the size or type of the property, provided the outstanding tax arrears were identified before the previous deadline.

According to a circular issued by the PMC finance department, the extension will not alter the reduced rates already stipulated under the scheme. Property owners can still clear their dues by paying only the principal amount, with penalties and interest waived entirely. The move is expected to boost voluntary compliance, particularly among low‑income residents who are often the most affected by bureaucratic delays and economic pressures. Stakeholders anticipate that the additional month will translate into a measurable uptick in collections, helping the corporation narrow the current fiscal gap without resorting to punitive measures.

Furthermore, the extension is being framed as a proactive step to encourage broader fiscal discipline in future tax cycles. By demonstrating a willingness to adapt to citizens’ realities, PMC hopes to foster a culture of regular, on‑time tax payments that ultimately strengthens municipal revenue streams and supports infrastructure projects.

Background of the Abhay Yojana

The Abhay Yojana was launched by PMC in mid‑2023 as a targeted relief programme for property owners struggling with arrears that accumulated during the COVID‑19 pandemic and the subsequent economic slowdown. The original scheme permitted eligible taxpayers to regularise their tax status by paying a discounted amount that covered only the assessed tax, with all penalties, surcharges, and interest removed for the duration of the amnesty period. The initiative was initially slated for six months, ending in January 2026, and was positioned as a “one‑time” measure to prevent widespread delinquency.

Eligibility criteria were clearly defined: the scheme applied to properties that were either newly assessed, had pending dues up to a maximum of ₹2 lakh, or were classified under the “residential low‑income” category based on the latest civic survey. Applicants were required to submit a simple affidavit and proof of ownership through the ward office, after which the PMC would issue a payment slip reflecting the reduced liability. The programme was heavily promoted through pamphlets, SMS alerts, and public announcements, but early data revealed that only 58 percent of the estimated 1.2 lakh eligible households had formally availed themselves of the scheme by the first deadline.

Officials highlighted that the Amnesty was not merely a fiscal concession but also a strategic effort to improve the city’s overall tax compliance culture. By offering a grace period, PMC aimed to encourage property owners who might have otherwise ignored their obligations to settle their liabilities voluntarily, thereby reducing the need for costly enforcement actions such as property attachments or legal proceedings.

Why Corporators Are Pushing for an Extension

During a recent standing committee meeting, several ward representatives voiced strong support for extending the amnesty by an additional month, arguing that the original window was insufficient to reach all eligible citizens. Corporator XYZ articulated the core concern: “Many residents, especially in underserved colonies, are still unaware of the scheme’s benefits or have faced delays in receiving official communications. A modest extension would allow them to clear their dues without incurring heavy penalties, thereby reducing the overall burden on the municipal treasury.”

Surveys conducted by the PMC’s taxation wing indicated that a significant proportion of households in peripheral areas—particularly in the eastern and western suburbs—had not submitted their applications before the deadline due to lack of awareness, limited access to ward offices, and competing domestic priorities. In addition, rising inflation rates have strained household budgets, making it difficult for some families to allocate the necessary funds even for reduced payments.

Corporators also pointed out that the extension could serve as a catalyst for improved civic engagement. By granting more time, the municipal administration can roll out targeted outreach campaigns—such as door‑to‑door awareness drives, community workshops, and multilingual informational videos—thereby ensuring that every eligible resident receives clear instructions on how to regularise their tax status before the new deadline.

Financial and Social Implications

From a fiscal perspective, granting the extension is projected to generate a modest but meaningful increase in immediate tax receipts. Preliminary estimates from the PMC finance department suggest that an additional one‑month window could yield up to ₹150 crore in voluntary payments, primarily from property owners who are on the cusp of settling arrears but require a few extra weeks to mobilise funds. This influx would help bridge part of the current municipal budget shortfall, which has been exacerbated by rising expenditures on health, education, and infrastructure.

However, analysts caution that the long‑term revenue impact must be weighed against the potential erosion of the tax base if extensions become a regular feature. Economists from the Indian Institute of Economic Development (IIED) note that a carefully managed extension can act as a “soft‑landing” mechanism, encouraging reluctant taxpayers to transition into a habit of timely payments, thereby expanding the formal tax net over subsequent years. Dr. Rohan Mehta, professor of Urban Economics at the University of Pune, remarked, “A short‑term extension, coupled with robust monitoring and transparent communication, can prevent a backlog of unpaid taxes while ensuring citizens do not feel penalised for circumstances beyond their control.”

On the social side, the extension is expected to alleviate stress among low‑income families who fear punitive action. By removing penalties and interest, the scheme reduces the financial shock associated with sudden tax liabilities, allowing households to allocate resources toward essential expenses such as food, education, and healthcare. Community leaders have reported that many families are choosing to invest their savings in home repairs or small‑scale entrepreneurship once their tax status is regularised, thereby stimulating localized economic activity.

Community Response and Next Steps

The grassroots response to the proposed extension has been overwhelmingly positive. Resident associations across Pune have organised rallies, filed petitions, and launched social‑media campaigns under the hashtag #AbhayYojanaExtension, which has already amassed thousands of interactions on platforms like Twitter and Facebook. Many local non‑governmental organisations have offered to assist the PMC in disseminating information through community centres, schools, and temples, ensuring that even the most remote wards are covered.

To maximise outreach, the corporation has announced a multi‑pronged communication strategy. Ward offices will display updated guidelines on notice boards, while official websites will host a dedicated FAQ section on the Abhay Yojana. SMS alerts, already in use for previous notifications, will be refreshed with the new deadline and a direct link to the online payment portal (PMC Property Tax Portal). Additionally, a series of webinars is scheduled to be conducted in collaboration with local chambers of commerce, aimed at guiding commercial property owners through the amnesty process.

The municipal council is slated to vote on the extension within the next fortnight. If approved, the new deadline of 28 February 2026 will take effect from the beginning of the upcoming fiscal quarter, giving residents a clear and actionable timeline. In the interim, the PMC finance department has pledged to monitor collections closely and publish monthly performance reports, thereby ensuring transparency and accountability throughout the extension period.

Stay updated with the latest Yojana schemes and government initiatives for better awareness and eligibility. For personalized guidance on accessing these benefits, reach out to us.