Pune Extends Abhay Yojana Deadline to March 15 – Property Tax Defaulters Get Relief

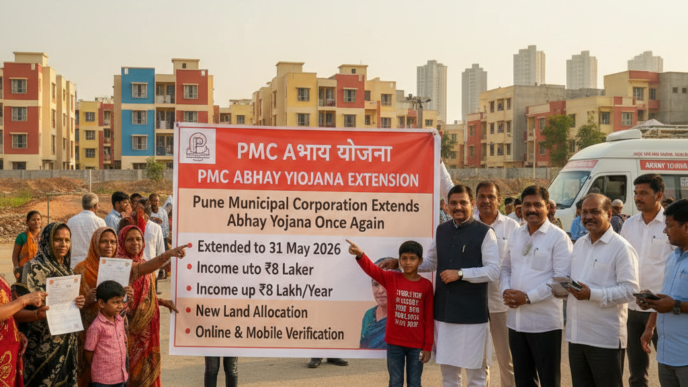

The Pune Municipal Corporation (PMC) has announced a two‑week extension of the Abhay Yojana deadline, moving the final date for availing the amnesty from February 28 to March 15, 2026. The decision, aimed at easing the financial burden on households still grappling with post‑pandemic economic pressures, will allow over 12,000 property owners across the city to regularise outstanding tax dues without incurring penalty interest. By granting this modest window of relief, the civic body hopes to reduce pending litigations, streamline revenue collection, and fund critical infrastructure projects slated for the upcoming fiscal year.

Senior civic officials explained that the extension follows repeated appeals from citizen groups, small‑scale entrepreneurs, and a surge in applications from suburban areas where overlapping economic stresses have made timely tax payments a challenge. “This extension reflects our commitment to a citizen‑centric approach,” said Additional Municipal Commissioner S. R. Nair during a press briefing. “We understand that many residents are navigating post‑pandemic financial constraints, and this modest relief will enable them to settle their obligations without the burden of accrued penalties.”

What Is Abhay Yojana and Who Is Eligible?

Launched in 2022, Abhay Yojana is a one‑time amnesty scheme that permits property tax defaulters to clear their arrears at a discounted rate while waiving the usual 12 % per annum interest that would otherwise accrue. The scheme is open to any property owner in Pune who meets the following criteria:

- Has pending property tax dues as of the original deadline.

- Submits a self‑declaration form confirming financial hardship.

- Provides supporting documents such as income proof, property tax assessment record, and a declaration of hardship.

- Applies through the official PMC online portal or visits any ward office before March 15, 2026.

Eligibility also extends to residential, commercial, and mixed‑use properties, provided the applicant can demonstrate a genuine hardship scenario — ranging from loss of employment to medical emergencies. The PMC has clarified that there is no cap on the amount of dues that can be regularised under the scheme, but applicants must settle the entire outstanding liability within the extended period.

Benefits and Relief Measures

The extended deadline brings several tangible benefits for property owners:

- Interest Waiver: Participants enjoy a full waiver on the 12 % annual interest that normally compounds on unpaid tax.

- Discounted Dues: The civic body offers a modest discount on the principal amount due, making the overall burden more manageable.

- Flexible Payment Options: Defaulters can choose to pay the entire sum in one lump‑sum or spread it across a structured installment plan tailored to their cash‑flow.

- Legal Safeguard: Once the application is approved, the scheme shields applicants from litigation, attachment of property, or penal action for the cleared dues.

According to preliminary estimates, the scheme could generate an additional ₹45 crore for the municipal budget if a substantial portion of defaulters takes advantage of the relief. This revenue influx is slated to fund road repairs, drainage upgrades, and improvement of public parks — projects long demanded by citizens across Pune’s 150 wards.

For many suburban residents, the extension is more than a fiscal reprieve; it represents an opportunity to avoid the cascade of penalties that could otherwise culminate in legal disputes and even property seizure. “The Amnesty Scheme is a lifeline for families who have been forced to choose between paying school fees and clearing tax arrears,” noted a local resident association spokesperson.

Step‑by‑Step Guide to Apply

Applying for the Abhay Yojana extension is straightforward, but applicants must act promptly to secure the benefits before the March 15 deadline. Here is the recommended process:

- Self‑Declaration Form: Complete the online form available on the PMC website (https://www.pune.gov.in) or obtain a physical copy at your nearest ward office.

- Gather Supporting Documents: Prepare a copy of your latest property tax assessment, proof of income (salary slips, business income statements, or pension letters), and a written declaration of financial hardship.

- Upload and Submit: Enter the documents in the portal under the “Abhay Yojana” section, ensuring all files are legible and up‑to‑date.

- Verification: The civic authority will review the submission within 7‑10 working days. Applicants will receive a confirmation email along with a unique application reference number.

- Payment Generation: Once approved, a payment slip with the discounted dues will be generated. This slip can be settled at any designated bank branch or via the PMC’s digital payment gateway.

- Receipt and Confirmation: After payment, download the receipt from the portal and retain it as proof of compliance.

Citizens are encouraged to use the online portal for its user‑friendly interface and real‑time tracking of application status. A dedicated task force, headed by Additional Commissioner S. R. Nair, has been set up to monitor submissions, ensure transparency, and address grievances promptly.

Expert Opinions and Future Outlook

While the extension is broadly welcomed, some fiscal analysts caution that a short‑term reprieve may not solve the underlying issue of chronic tax delinquency. “Amnesty schemes are valuable safety nets, but they should be complemented with robust taxpayer education, streamlined assessment processes, and targeted subsidies for low‑income groups,” said Dr. Meera Deshmukh, a professor of public finance at the University of Pune.

Statewide, the Maharashtra government has introduced similar amnesty programmes for water and electricity dues, signalling a coordinated policy shift toward balancing revenue expectations with social equity. The PMC’s move reflects this broader trend and could serve as a catalyst for deeper fiscal reforms within the corporation.

Looking ahead, the civic body plans to roll out a comprehensive digital taxation ecosystem that integrates property registration, tax assessment, and payment on a single platform. This initiative aims to reduce manual errors, enhance collection efficiency, and foster a culture of proactive compliance among residents. Officials believe that such technological upgrades, coupled with the current amnesty extension, will create a virtuous cycle of fiscal responsibility and community engagement.

For residents eager to clear their tax status and avoid last‑minute complications, the message is clear: submit your application, regularise your dues, and take advantage of the reduced penalties before March 15. Prompt action not only shields you from accruing interest but also contributes to the city’s infrastructural development and overall welfare.

Stay updated with the latest Yojana schemes and government initiatives for better awareness and eligibility. For personalized guidance on accessing these benefits, reach out to us.