Extended Deadline for Pradhan Mantri Awas Yojana Registration

The Union Ministry of Housing and Urban Affairs has announced a two‑month extension for the Pradhan Mantri Awas Yojana (PMAY) registration window. The revised deadline now falls on 31 December 2025, allowing prospective beneficiaries additional time to complete the online self‑certification process. This decision follows widespread requests from state governments, banking partners, and citizen groups who highlighted logistical bottlenecks, especially in high‑density metros where the traditional cutoff of 31 October 2025 left many eligible families unable to submit applications. The extension applies equally to both the Credit Linked Subsidy Scheme (CLSS) and the In‑Situ Upgradation Scheme (IHS), ensuring that applicants across urban and rural India can still pursue affordable home ownership under the flagship “Housing for All” initiative.

Understanding the Scheme: A Quick Overview

Launched in June 2015, PMAY aims to provide affordable housing to all eligible urban and rural households by the year 2022, aligning with the government’s broader Sustainable Development Goals. The scheme operates through four verticals—Credit Linked Subsidy Scheme (CLSS), In‑Situ Upgradation Scheme (IHS), Beneficiary Led Construction (BLC), and Affordable Housing in Partnership (AHP). Under CLSS, eligible families receive an interest subsidy of up to 6.5 % on home loans for a maximum tenure of 15 years. The IHS, targeted at slum dwellers, offers a direct cash assistance of up to ₹2 lakh for house upgrades. The scheme also promotes gender equity by reserving 33 % of subsidy allocations for female‑headed households. For detailed official information, refer to the PMAY portal or the Wikipedia entry.

Eligibility Criteria and What It Means for Applicants

To qualify for PMAY, applicants must meet a set of clearly defined eligibility conditions:

- The applicant must be an Indian citizen.

- Eligibility is limited to households that do not own any pucca ( Permanently constructed) house anywhere in India.

- Annual family income must not exceed ₹3 lakh for Economically Weaker Sections (EWS), ₹6 lakh for Low‑Income Group (LIG), ₹12 lakh for Middle Income Group‑I (MIG‑I), and ₹18 lakh for Middle Income Group‑II (MIG‑II).

- No member of the family should have previously benefited from any central housing scheme such as Indira Gandhi Awaas Yojana.

- The scheme is open to individuals, couples, and families, with special provisions for women, senior citizens, and persons with disabilities to encourage inclusive participation.

>

These criteria are designed to target the most vulnerable sections of society while preventing duplication of benefits. The income thresholds are periodically reviewed; the latest revision was announced in the 2024 Union Budget, raising the MIG‑II ceiling to ₹18 lakh to reflect inflation and urban cost‑of‑living changes.

Required Documents: A Step‑by‑Step Checklist

Applicants are required to upload a specific set of documents during the online registration. The complete checklist includes:

- Proof of Identity: Aadhaar card, Voter ID, or Passport.

- Proof of Residence: Ration card, recent utility bill, or lease agreement.

- Income Proof: Salary slips for the last three months, Income Tax Return (ITR) copy, or an employer‑issued income certificate.

- Bank Statements: The last three months’ statements to demonstrate cash flow and repayment capacity.

- Property Documentation: Allotment letter, sale agreement, or builder’s agreement for the proposed house (mandatory for CLSS applicants).

- Photographs: Two passport‑size photographs in JPEG format.

- Completed Application Form: Filled and signed as per the portal’s instructions.

Ensuring that each document is clear, legible, and in the prescribed format helps expedite the verification process and reduces the likelihood of rejection.

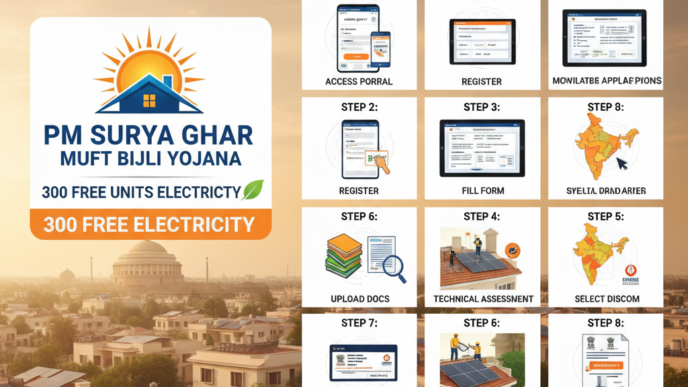

How to Apply Online: A Detailed Guide

The entire PMAY registration process is conducted through the official government portal. Follow these steps to submit your application:

- Visit the official website pmaymis.gov.in and click on the “Self‑Certification” tab.

- Register by providing your mobile number and email address.

- Select the appropriate income category—EWS, LIG, MIG‑I, or MIG‑II.

- Enter personal details accurately and upload the required documents as listed above.

- Fill in the property details, including location, size, and cost of the proposed house.

- Pay the nominal registration fee, if applicable, using net banking, credit/debit card, or UPI.

- Submit the application and retain the acknowledgment receipt number for future reference.

After submission, the concerned State or Union Territory (UT) housing authority reviews the application, conducts field verification, and may request additional information. Upon successful verification, the applicant receives a sanction letter detailing the subsidy amount, loan disbursement schedule, and repayment terms. For further assistance, applicants can refer to the Ministry of Housing and Urban Affairs FAQ section.

Financial Benefits and Subsidy Structure

PMAY offers several tangible financial incentives that significantly lower the cost of home ownership:

- Interest Subsidy: Up to 6.5 % per annum on home loans for a maximum repayment period of 15 years, applicable under the CLSS.

- Direct Assistance: Up to ₹2 lakh under the In‑Situ Upgradation Scheme for slum upgrading and house improvement.

- No‑Cost Registration: Many states waive registration fees for women applicants and senior citizens.

- Credit History Building: By engaging formal banking channels, beneficiaries establish a credit footprint, facilitating future financial transactions.

These benefits are designed to make affordable housing financially viable for low‑ and middle‑income families. According to a 2023 impact assessment by the National Institute of Public Finance and Policy (NIPFP), over 1.2 million families have already received subsidies, resulting in an estimated aggregate saving of ₹9,800 crore in interest payments over the loan tenures.

Citizen Impact: Real‑World Examples and Outlook

The extended registration deadline is projected to boost enrolment by an additional 1.5 million households, particularly in metropolitan regions such as Delhi, Mumbai, and Bengaluru where housing affordability remains a critical challenge. Early field reports from the Ministry indicate heightened applications from women‑headed households and senior citizens, reflecting growing awareness and trust in the digital application process. Moreover, the streamlined online workflow has reduced average verification time from 60 days to around 30 days, enabling faster disbursement of subsidies. Urban planners and housing experts anticipate that this extension will accelerate the achievement of the “Housing for All” target, aligning with the United Nations’ Sustainable Development Goal 11 on sustainable cities and communities.

Industry stakeholders also view the extension positively. In a recent interview with India Today, Dr. R. S. Sharma, Director of the Centre for Housing Studies, highlighted, “The two‑month extension provides a vital window for families who faced delays due to pandemic‑related disruptions. It also encourages financial institutions to process loans more efficiently, ultimately benefitting the broader economy.”

Frequently Asked Questions

Q1: Can I apply if I already own a house? A: No. PMAY explicitly excludes applicants who possess any pucca house anywhere in India.

Q2: Is there a limit on the number of applications per family? A: Only one application is permitted per family unit under the scheme.

Q3: How long does verification take after submission? A: Typically 30‑45 days, after which a sanction letter is issued.

Q4: Will the subsidy amount change due to the extension? A: No. The subsidy percentages and caps remain unchanged; only the registration window is extended.

Q5: Are there any special provisions for women applicants? A: Yes. Many states provide fee waivers and priority processing for applications submitted by women.

Stay updated with the latest Yojana schemes and government initiatives for better awareness and eligibility. For personalized guidance on accessing these benefits, reach out to us.