Introduction

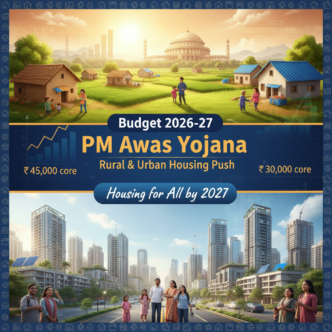

The Pradhan Mantri Awas Yojana 2.0, launched in 2026, marks the next evolutionary step of India’s flagship housing‑for‑all programme. Building on the achievements of the original Pradhan Mantri Awas Yojana, the 2.0 version introduces a fully digital application pathway, expanded subsidy brackets, and a broader eligibility net that targets both urban and rural households. While the first phase aimed to deliver pucca houses to every Indian family by 2022, the 2.0 iteration pushes the horizon to 2026 and integrates modern technology to accelerate beneficiary identification, reduce processing time, and promote sustainable construction practices. The scheme’s core mission remains to ensure that every citizen, regardless of income, can access safe, affordable shelter, and the new version leverages data analytics and blockchain‑based verification to minimise fraud and expedite subsidy disbursement.

Eligibility Criteria

Eligibility for Pradhan Mantri Awas Yojana 2.0 has been substantially widened to capture a larger segment of the population. In urban areas, families with an annual income of up to ₹18 lakhs qualify, while in rural regions the ceiling rises to ₹12 lakhs. The scheme also extends assistance to households that already own a pucca house measuring less than 60 sq metres, provided they have not previously received benefits under the original PMAY. Priority is given to Scheduled Castes, Scheduled Tribes, Persons with Disabilities and women‑headed households, ensuring that marginalised sections receive accelerated approval. Applicants must possess a valid Aadhaar number, submit income proof through recent salary slips or income‑tax returns, and provide property details of the intended dwelling. Key eligibility points include:

- Urban income ≤ ₹18 lakhs or rural income ≤ ₹12 lakhs

- Ownership of a small pucca house (<60 sq m) or no permanent house

- Belonging to S.C., S.T., PWD or women‑head households for priority

According to the Ministry of Housing and Urban Affairs, these relaxed criteria are expected to bring an additional 12 million families under the subsidy ambit by 2027, accelerating progress toward the “Housing for All” vision.

Subsidy Details

The subsidy architecture of Pradhan Mantri Awas Yojana 2.0 is designed to maximise cash‑flow relief for beneficiaries. For low‑income families, the government provides an upfront interest subsidy of up to 4 percent on home loans of up to ₹25 lakhs, effectively reducing the Equated Monthly Instalment (EMI) burden by several thousand rupees. High‑income applicants can still claim a modest 2 percent subsidy on loans up to ₹15 lakhs. The subsidy is credited directly to the lending institution once the loan is sanctioned, eliminating the need for manual claim filing and shortening the disbursement cycle from months to days. Interest subsidy details Moreover, the scheme permits a top‑up loan of up to ₹5 lakhs for home improvement, allowing beneficiaries to expand or renovate their houses without jeopardising subsidy eligibility. This integrated financial model ensures that the cost of borrowing is comparable to market‑rate personal loans, making home ownership financially viable for millions.

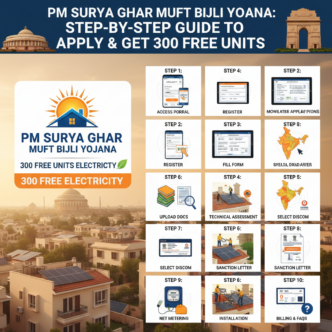

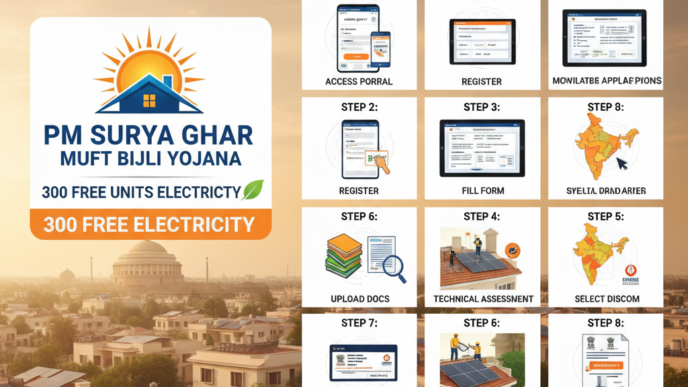

Online Application & Home Loan Benefits

The application journey for Pradhan Mantri Awas Yojana 2.0 is entirely web‑based and can be completed from any internet‑enabled device. Prospective beneficiaries begin by registering on the official PMAY portal, where they upload Aadhaar details, income documentation and property photographs. The system automatically validates the data against the Ministry’s central database and assigns a unique application reference number. Within 48 hours, applicants receive an SMS and email alert confirming receipt and indicating the next steps. A built‑in map visualisation helps users locate nearby approved housing projects, while a status tracker displays real‑time progress from verification to sanction. For those unfamiliar with digital tools, the portal offers multilingual tutorials and a toll‑free helpline staffed by trained officers. Visit the PMAY portal to start the application. Once the loan is sanctioned, the subsidy is transferred directly to the bank, and borrowers may choose from flexible repayment tenures of up to 20 years, with the option of fixed or floating interest rates. This streamlined process not only reduces paperwork but also expands financial inclusion by partnering with a wide network of scheduled banks and housing finance companies.

Future Outlook and Impact

Looking ahead, the Ministry of Housing and Urban Affairs plans to embed renewable‑energy standards into the design of Pradhan Mantri Awas Yojana 2.0 houses, mandating solar‑ready rooftops and energy‑efficient LED lighting in all new constructions. Pilot projects in the Delhi‑NCR smart‑city corridor are testing modular, pre‑fabricated housing units that cut construction time by 30 percent and reduce material waste. Continuous feedback loops with beneficiaries will drive periodic revisions to eligibility thresholds and subsidy formulae, ensuring the scheme stays responsive to inflationary pressures and evolving income patterns. Early impact assessments from pilot states such as Gujarat and Madhya Pradesh reveal a 25 percent surge in loan approvals among first‑time home seekers, while the average subsidy disbursement lag has shrunk from six months to under two weeks. These metrics illustrate how the digital push is translating into tangible financial relief for millions of Indians, while also stimulating job creation in the construction sector and promoting sustainable urban development.

Stay updated with the latest Yojana schemes and government initiatives for better awareness and eligibility. For personalized guidance on accessing these benefits, reach out to us.