Overview of PM Mudra Yojana

The Pradhan Mantri Mudra Yojana (PM‑MUDRA) was launched in April 2015 by the Ministry of Finance to provide affordable, unsecured credit to micro and small enterprises across India. The scheme is built around three financing stages—Shishu, Kishore and Tarun—reflecting the evolution of a business from inception to growth. Shishu targets loan seekers needing up to ₹50,000, Kishore covers amounts between ₹50,001 and ₹5 lakh, while Tarun accommodates borrowers requiring ₹5 lakh‑₹10 lakh. Since its inception, the programme has recorded more than 120 million loan applications and disbursed over ₹3 lakh crore in credit, reaching urban slums, rural clusters, and tribal areas alike. The scheme’s reach is amplified by partnerships with scheduled commercial banks, regional rural banks, cooperative banks, small finance institutions and NBFCs, all of which act as conduits for loan processing and monitoring.

Mudra’s core promise is low‑cost financing combined with a government‑backed credit guarantee covering up to 80 % of the sanctioned amount. Interest rates vary by lender but are generally lower than market‑driven personal loans, and the scheme offers special subvention for women‑owned enterprises, agricultural micro‑units and certain socially disadvantaged groups. Moreover, the digital Mudra Portal enables applicants to submit digitised business plans, upload KYC documents and track loan status in real time, reducing paperwork and speeding up disbursement.

Fee Structure Clarified by PIB

Recent social‑media speculation suggested that the central government imposes a processing fee on Mudra loans, prompting confusion among prospective borrowers. The Press Information Bureau (PIB) has now issued an official clarification stating that **no fee is charged by the government** for sanctioning Mudra credit. Any charge a borrower may encounter originates solely from the lending institution and reflects the bank’s own processing or administrative cost. The PIB release, accessible via the official portal pib.gov.in, underscores that the scheme is fully funded through a credit guarantee fund and interest subvention, eliminating any central levy.

According to the clarification, banks are required to disclose any fee component upfront in the loan sanction letter, and borrowers should verify the exact amount before proceeding. The government’s emphasis on transparency is intended to prevent hidden charges and protect small entrepreneurs from unexpected cost burdens.

What the PIB Statement Says

The PIB statement cites the comprehensive Mudra guidelines released by the Ministry of Finance and the Department of Financial Services. It reiterates that the scheme’s objective is to “provide collateral‑free, affordable credit to micro‑enterprises” without imposing any statutory processing fee. The document highlights three key points:

- Any fee evident in a Mudra transaction is levied by the bank and must be clearly communicated to the borrower.

- The only government‑related cost is the credit guarantee premium paid by the lending institution, which does not manifest as a charge to the end‑user.

- Borrowers are advised to compare loan offers across multiple Mudra‑participating banks to secure the most competitive terms.

By publishing this clarification, PIB aims to reinforce public confidence in Mudra and curb misinformation that could deter eligible applicants from seeking credit under the scheme.

Implications for Small Business Owners

For micro‑entrepreneurs—especially those operating in rural and semi‑urban locales—the assurance of a fee‑free central charge simplifies the financing journey. Entrepreneurs can approach their preferred bank with a clearer understanding that only the lender’s processing cost may apply, which typically ranges from 0.25 % to 1 % of the loan amount and is disclosed at the outset. This transparency reduces the apprehension that often accompanies loan applications and encourages more first‑time borrowers to formalise their funding needs.

Given that Mudra loan limits can extend up to ₹10 lakh, the scheme serves as a crucial financial bridge for businesses that lack collateral or credit history. The tiered structure enables borrowers to scale their credit requirement as the enterprise expands, avoiding the need to re‑apply for a new loan at each growth stage. Additionally, many participating banks offer preferential interest rates for women‑owned ventures and startups in the agriculture value‑chain, further enhancing affordability and fostering inclusive economic development.

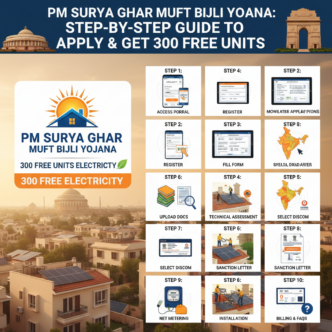

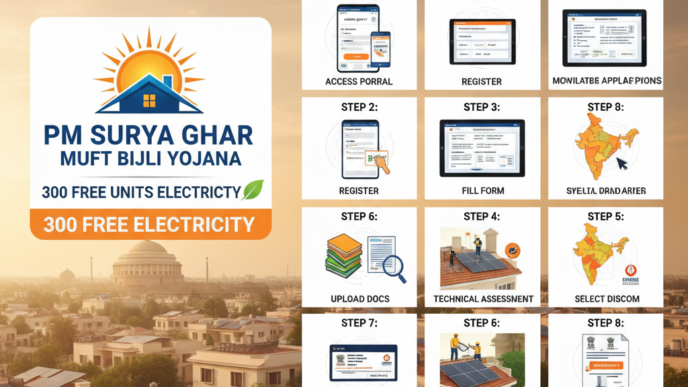

How to Apply for a Mudra Loan

Prospective applicants can initiate a Mudra loan request through any authorised financial institution that participates in the scheme—be it a public sector bank, a private commercial bank, a regional rural bank, a cooperative bank, a small finance bank, or an NBFC. The application process typically involves the following steps:

1. **Document preparation** – Submit identity proof (Aadhaar, PAN or passport), address proof, business address proof, and a brief business plan outlining the venture’s objectives, cash‑flow projections and repayment roadmap.

2. **Online submission** – Many banks now host a Mudra‑specific portal where applicants can upload scanned documents, fill an electronic form and track the status of their application in real time.

3. **Eligibility assessment** – The lending institution evaluates the applicant’s creditworthiness, business viability and categorises the loan under Shishu, Kishore or Tarun based on the requested amount and stage of business development.

4. **Sanction and disbursement** – Once approved, the loan is sanctioned within 15‑30 days, after which the sanctioned amount is transferred directly to the borrower’s bank account. The entire workflow can be completed digitally, minimising the need for physical visits.

Applicants are encouraged to verify the exact fee structure, interest rate and repayment tenure with the chosen bank before signing the sanction letter.

Key Benefits of the Scheme

Mudra Yojana stands out for its borrower‑friendly features, many of which are highlighted below:

- No processing fee charged by the government – The central scheme does not levy any fee, ensuring that borrowers only contend with lender‑specific charges.

- Low, often subsidised interest rates – Competitive rates are further reduced for women entrepreneurs, agricultural micro‑units and startups operating in priority sectors.

- Flexible repayment tenure – Repayment periods can extend up to five years, allowing cash‑flow‑sensitive businesses to plan repayments without strain.

- Credit guarantee coverage – The government’s guarantee covers up to 80 % of the loan amount, reducing the risk premium for lenders and enabling more favourable terms for borrowers.

- Digital application ecosystem – The Mudra Portal and mobile apps streamline documentation, status tracking and disbursement, cutting processing time significantly.

Addressing Common Misconceptions

One persistent myth is that Mudra imposes a mandatory government fee on every loan sanction. The PIB clarification clearly debunks this notion, stating that any fee is exclusively at the discretion of the lending institution and is not mandated by the scheme itself. Borrowers should therefore read the sanction letter carefully, ask the bank for a detailed breakdown of any processing or administrative charges, and confirm whether those costs are negotiable. Transparency in fee disclosure is a cornerstone of the scheme’s credibility and helps maintain trust between financiers and small‑scale entrepreneurs.

Another frequently asked question concerns the eligibility of borrowers who have previously taken a Mudra loan. The scheme allows repeat applicants provided the previous loan has been fully repaid and the business continues to meet the category criteria. This policy encourages entrepreneurship cycles and supports scaling-up of successful micro‑ventures.

Impact on Women‑Led Enterprises

Women entrepreneurs constitute a vibrant segment of the Mudra ecosystem, accounting for more than 30 % of all sanctioned loans as of the latest fiscal year. Recognising this demographic’s potential, the Ministry of Finance, in collaboration with the National Bank for Agriculture and Rural Development (NABARD), has launched targeted capacity‑building workshops and mentorship programmes aimed at women‑owned micro‑enterprises. By removing any central fee barrier, Mudra enhances financial accessibility for women, enabling them to invest in raw material procurement, technology upgrades and market expansion. The scheme’s gender‑sensitive approach not only empowers individual women but also contributes to broader socio‑economic upliftment in communities where women traditionally faced credit constraints.

Case studies from states such as Maharashtra, Uttar Pradesh and Tamil Nadu illustrate how women‑led cooperatives have leveraged Mudra loans to transition from informal home‑based production to formally registered enterprises, thereby gaining access to larger markets and formal credit channels.

Future Outlook and Policy Enhancements

Looking ahead, the Indian government plans to deepen Mudra’s impact through a series of policy enhancements slated for the upcoming fiscal budget. Key initiatives include expanding the digital Mudra Portal to integrate with the Ministry’s “One‑Stop Government Services” ecosystem, thereby simplifying cross‑state loan applications for migrant entrepreneurs. Additionally, the Finance Ministry has earmarked increased funding for credit guarantee reserves, aiming to lower the risk premium for participating banks and further reduce interest rates for priority sectors.

There is also a strategic push to onboard more fintech partners, enabling borrowers to apply for Mudra loans through seamless mobile‑first interfaces and AI‑driven credit assessment tools. Such innovations are expected to shorten sanction timelines to under 10 days, making credit almost instantaneous for micro‑enterprises that operate on tight cash cycles. Continuous monitoring, coupled with feedback loops from state‑level implementation agencies, will ensure that Mudra remains responsive to emerging entrepreneurial challenges and opportunities.

Stay updated with the latest Yojana schemes and government initiatives for better awareness and eligibility. For personalized guidance on accessing these benefits, reach out to us.