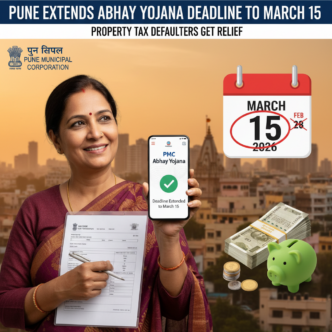

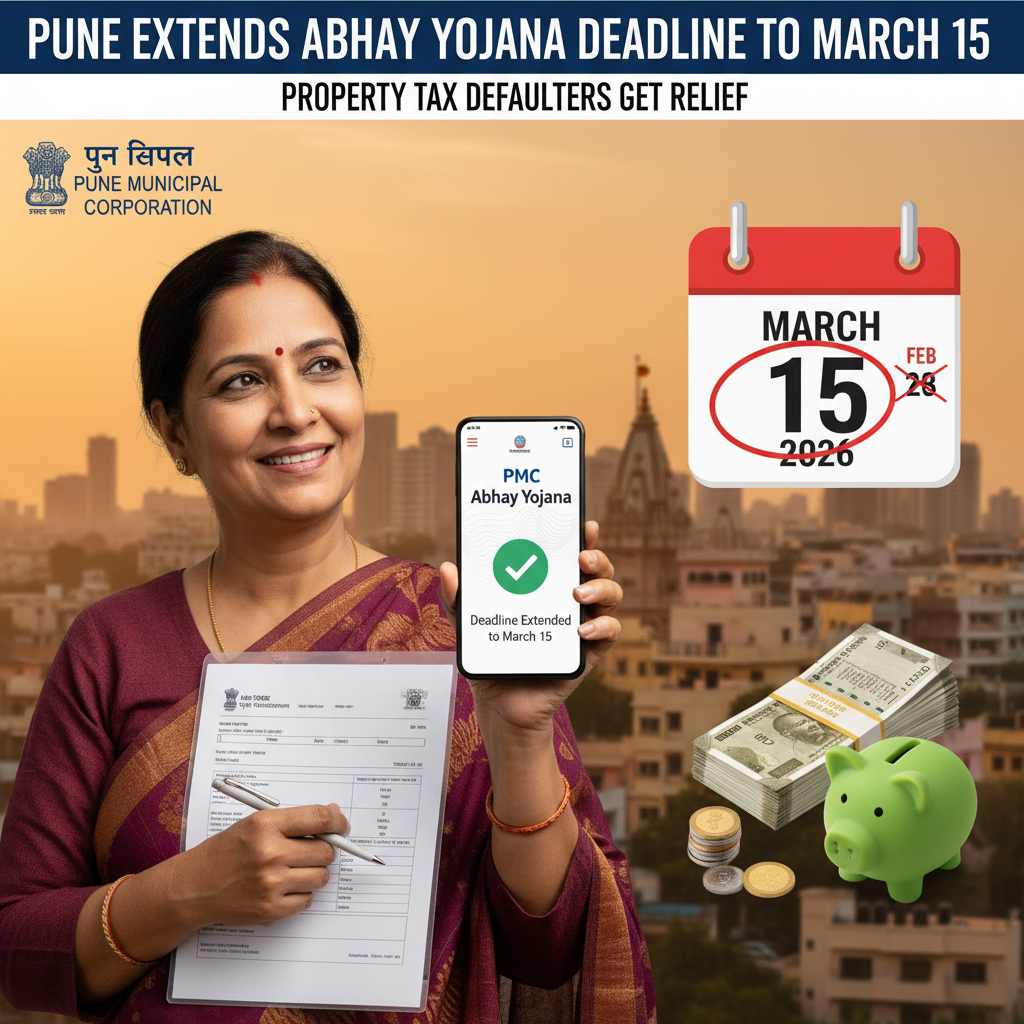

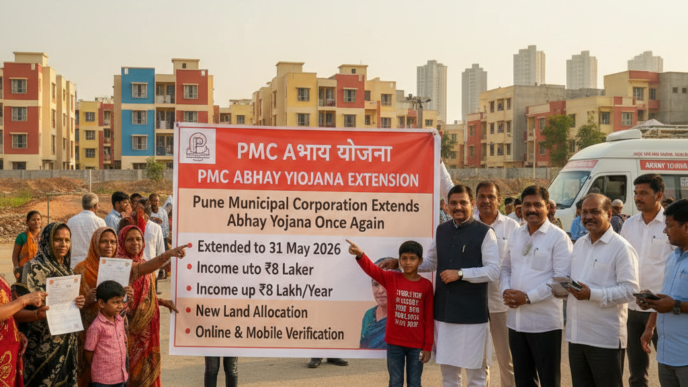

Extended Deadline Brings Hope to Property Tax Defaulters in Pune

The Pune Municipal Corporation (PMC) has announced a crucial extension of the Abhay Yojana deadline, moving the final submission date from February 28 to March 15, 2026. This decision aims to ease the financial pressure on households and small enterprises that have struggled with mounting tax liabilities amid rising inflation and lingering pandemic effects. By granting an additional two weeks, the civic body provides a clear window for property owners to regularise their tax status without fear of penalties or legal action. Municipal officials anticipate that this grace period will significantly boost revenue recovery, helping the corporation close a backlog of uncollected dues estimated at over ₹1,200 crore. The extension also underscores a broader shift towards citizen‑centric fiscal policies that balance revenue needs with social equity.

How the Abhay Yojana Works: Eligibility and Benefits

Introduced as a one‑time amnesty scheme, the Abhay Yojana was designed to assist owners of residential, commercial, and mixed‑use properties who have fallen behind on their property tax payments. Eligibility criteria include:

- Properties located within the PMC jurisdiction that have pending tax arrears not exceeding three fiscal years.

- Applicants must be Indian citizens and provide valid ownership documents, PAN or Aadhaar details, and a self‑declaration explaining the cause of non‑payment.

- Partial payments are permitted, allowing taxpayers to settle the outstanding amount in installments over the extended period.

Key benefits of the scheme include the waiver of interest and penalty charges during the extension window, streamlined online payment through mobile wallets, internet banking, and designated bank branches, and the opportunity to regularise tax status without facing enforcement actions such as property attachment. The scheme also seeks to promote transparency by directing users to a dedicated portal where they can track application status in real time.

Implementation Details: Online Portal and Awareness Drive

To facilitate smooth participation, the PMC has upgraded its digital tax platform to include a dedicated Abhay Yojana dashboard. Property owners can log in at the official portal (Pune Municipal Corporation Tax Portal), view their outstanding dues, upload scanned copies of required documents, and generate a payment slip. The portal also offers a step‑by‑step tutorial video for users unfamiliar with online tax services.

In addition to the online push, the civic administration has launched a multi‑channel awareness campaign across 150 municipal wards. Partnerships with local NGOs, resident welfare associations, and community leaders will deliver printed flyers, host interactive workshops, and broadcast updates via WhatsApp groups and regional radio stations. A 24‑hour helpline (toll‑free 1800‑123‑4567) has been set up to answer queries, guide applicants through document verification, and assist those needing offline assistance.

Economic and Fiscal Implications for Pune

The extension is expected to generate a measurable uplift in tax compliance, with early modelling suggesting a collection of an additional ₹350 crore in property tax revenues by the end of the fiscal year. This influx will help fund critical municipal services—ranging from waste management and water supply to road maintenance and public transport—without resorting to higher tax rates. Moreover, by reducing the volume of disputed cases, the PMC can streamline enforcement actions and focus resources on preventive maintenance rather than punitive measures.

From a macro‑economic perspective, the scheme aligns with broader state initiatives to promote fiscal resilience during periods of slowdown. Experts from the Maharashtra Economic Survey 2024 note that flexible tax amnesty programmes can improve taxpayer morale and encourage voluntary compliance, ultimately widening the tax base in the long run. If successful, the Pune model may inspire similar extensions in Mumbai, Nagpur, and other urban local bodies across Maharashtra.

Citizen Reactions and Future Outlook

Community feedback has been overwhelmingly positive. Resident welfare societies in areas such as Hinjewadi and Kothrud have organised informational webinars, praising the extension as a “people‑centric” gesture that acknowledges the economic hardships faced by many families. Small shop owners in the Mandai market district expressed relief, stating that the additional time will allow them to allocate funds to inventory purchases without jeopardising tax obligations.

However, certain watchdog groups caution that the scheme’s effectiveness hinges on the accessibility of the online portal and the efficiency of the verification process. They have recommended that the PMC adopt a robust grievance redressal mechanism and ensure that rural and peri‑urban pockets receive adequate support to navigate the digital interface. Looking ahead, policymakers plan to evaluate key performance indicators—such as the volume of applications processed, the reduction in delinquency rates, and overall taxpayer satisfaction—to determine whether periodic Abhay Yojana extensions should become a permanent fixture in the civic fiscal calendar.

Stay updated with the latest Yojana schemes and government initiatives for better awareness and eligibility. For personalized guidance on accessing these benefits, reach out to us.