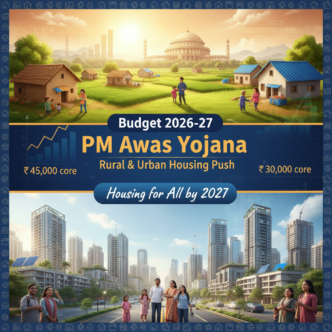

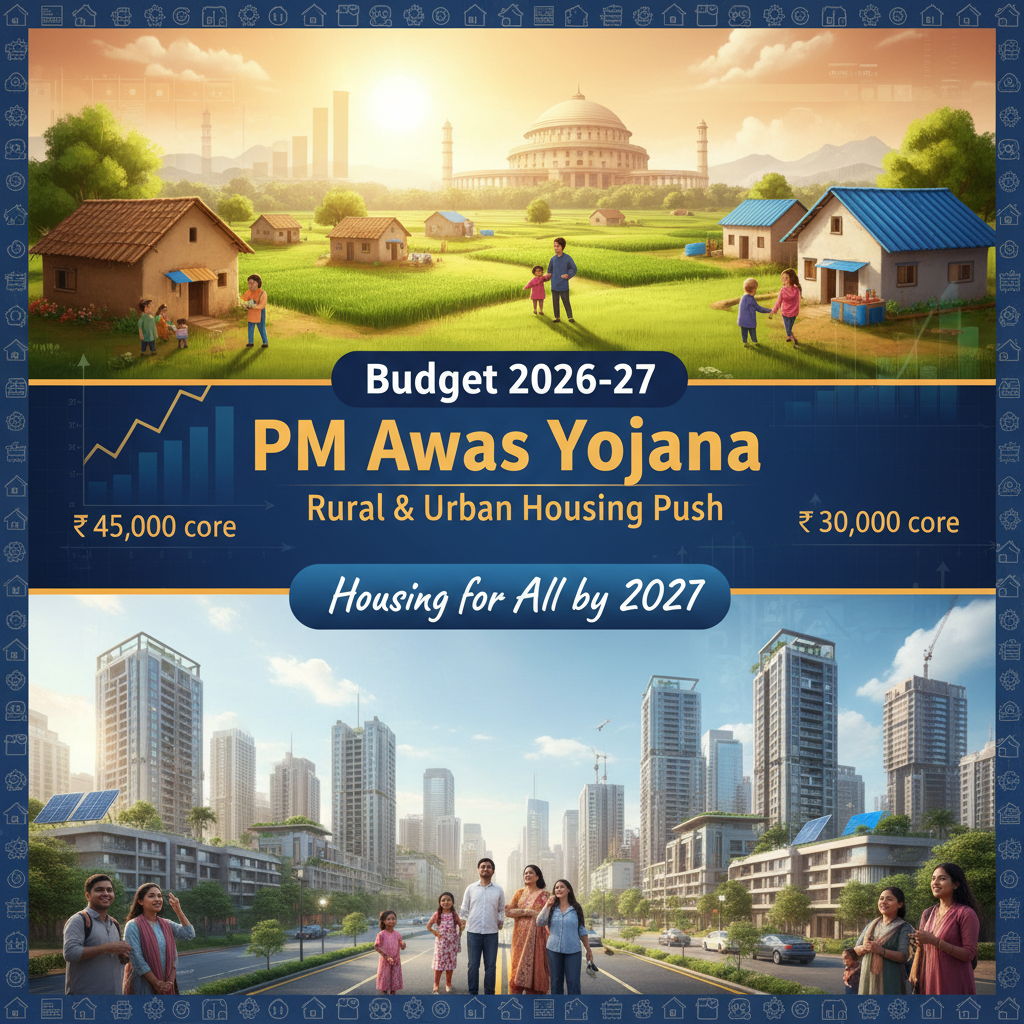

Key Highlights of Budget 2026–27 for Housing

The Union Budget 2026–27, presented by Finance Minister Nirmala Sitharaman, earmarks a record Rs 75,000 crore for the Pradhan Mantri Awas Yojana (PMAY). This represents a 20 % increase over the previous fiscal year and signals the government’s intent to accelerate the “Housing for All” agenda by 2027. The allocation is split into Rs 45,000 crore for rural housing and Rs 30,000 crore for urban housing, reflecting a dual‑track approach that addresses the distinct challenges of each sector. Official Budget documents show that the funds will be distributed across three core components of PMAY – the Credit Linked Subsidy Scheme (CLSS), In‑Situ Rehabilitation (IRA), and Affordable Housing in Partnership (AHP). The emphasis on increased subsidies, expanded credit guarantees, and new partnership models is designed to fast‑track construction of affordable houses for low‑income families, clear existing slum backlogs, and stimulate the construction ecosystem.

Rural Housing Push

Under the rural component, the budget reinforces the “Housing for All” mission with a target of constructing 30 million additional houses by the end of FY 2027. The initiative prioritises households below the poverty line (BPL), marginal farmers, and tribal communities, aiming to provide them with secure, pucca dwellings. A new sub‑scheme, the Gram Awas Yojana, will be piloted in 150 panchayats across high‑need states such as Odisha, Jharkhand, and Madhya Pradesh. This gram‑level planning model leverages local governance structures to identify eligible beneficiaries, streamline land acquisition, and coordinate the delivery of construction material subsidies. Financial assistance will be delivered through a mix of direct cash transfers, low‑interest home loans, and material vouchers, ensuring that beneficiaries can choose the mode that best suits their circumstances.

- Target: 30 million houses by 2027

- Primary beneficiaries: BPL families, marginal farmers, tribal groups

- Funding: Rs 45,000 crore allocated to rural housing

- Delivery mechanisms: Direct cash transfers, low‑interest loans, material subsidies

The scheme also incorporates a robust monitoring dashboard that will track beneficiary enrolment, construction milestones, and fund utilisation on a monthly basis. According to the Ministry of Housing and Urban Affairs, the digital platform will integrate data from the Data Management System and the PMAY portal, enabling real‑time oversight and rapid course‑correction.

Urban Housing Initiatives

Urban housing receives a complementary boost through the introduction of the Smart City Housing Scheme. This programme ties affordable housing to the broader smart‑city agenda by embedding low‑cost dwellings within designated smart‑city precincts. The scheme encourages public‑private partnerships (PPPs) to redevelop densely populated slums, regularise tenure, and upgrade basic services such as water, sanitation, and electricity. A key innovation is the Urban Credit Guarantee Fund, which will provide a government‑backed guarantee covering up to 30 % of the loan value for low‑income urban households seeking home financing. This guarantee is expected to lower borrowing costs by 0.5–1 percentage points, expanding access to formal credit for millions of urban poor.

- Scheme: Smart City Housing Scheme

- Core focus: Slum redevelopment, tenure regularisation, basic service provision

- Partnership model: Public‑private collaborations for construction and management

- Support mechanism: Urban Credit Guarantee Fund for home loans

According to a recent report by the India Water Portal, the integration of affordable housing with smart‑city infrastructure can reduce per‑unit service costs by up to 15 % through shared utilities and consolidated infrastructure. The budget also proposes a revision of floor‑space ratio (FSR) norms in designated urban development zones, allowing developers to increase building density while reserving at least 30 % of the new floor area for affordable units. This policy lever aims to attract private developers into the low‑cost segment, accelerating supply growth.

Policy Measures Supporting Awas Yojana

Beyond direct funding, the 2026–27 budget introduces a suite of policy levers to reinforce PMAY’s impact. First, tax incentives have been expanded: developers that allocate a minimum of 30 % of their portfolio to affordable housing will qualify for an additional 5 % deduction on corporate tax, encouraging greater private‑sector participation. Second, the Credit‑Linked Subsidy Scheme ceiling has been raised from Rs 2 lakh to Rs 2.5 lakh per applicant, increasing the subsidy quantum and broadening eligibility to families with slightly higher incomes. Third, the government has streamlined clearance procedures by launching a single‑window clearance system at the state level, reducing the average approval time for housing projects from 180 days to 60 days. Finally, a new “Affordable Housing in Partnership (AHP) Extension” will allow state governments to partner with cooperative societies and NGOs to construct homes on government‑owned land, with the central government providing a 20 % matching grant.

- Tax incentive: 5 % corporate tax deduction for developers delivering ≥30 % affordable housing

- CLSS subsidy ceiling raised to Rs 2.5 lakh per beneficiary

- FSR relaxation in urban development zones to boost densification of affordable units

- Single‑window clearance system to cut project approval timelines by two‑thirds

- AHP Extension: 20 % central matching grant for state‑NGO partnerships

These measures are designed to create an enabling environment for rapid, large‑scale construction while ensuring that the financial burden does not disproportionately fall on low‑income households.

Financial Allocation and Fiscal Impact

Breaking down the Rs 75,000 crore allocation, the CLSS receives Rs 18,000 crore, the IRA gets Rs 15,000 crore, and the AHP component is allocated Rs 42,000 crore. This distribution underscores the government’s tilt toward partnership models that leverage private expertise and capital, while still maintaining a strong emphasis on direct subsidies for credit‑linked assistance. From a fiscal standpoint, the additional spending is projected to increase the fiscal deficit by 0.2 percentage points, taking it to 5.8 % of GDP. The Finance Ministry plans to finance the incremental outlay through a combination of higher customs duties on luxury imports and a modest borrowing programme targeted at infrastructure development. Analysts from the NITI Aayog think‑tank suggest that the fiscal impact will be offset by the anticipated economic stimulus from the construction sector, which is expected to generate 4.5 million new jobs over the next three years.

Moreover, the budget highlights a strategic shift toward outcome‑based financing. Each housing project will be tied to a set of performance indicators—such as completion rate, beneficiary satisfaction, and timely fund utilisation—whose achievement will unlock subsequent tranches of funding. This results‑oriented approach aims to enhance accountability and ensure that allocated resources translate into concrete, on‑the‑ground outcomes.

Implementation Timeline and Monitoring

The Ministry of Housing and Urban Affairs is slated to release a detailed implementation roadmap in the coming months. Key milestones include:

- Q1 2026: Launch of the Gram Awas Yojana and allocation of state‑wise targets for rural housing

- Q2 2026: Disbursement of the first tranche of funds to rural panchayats and urban municipalities

- Q3 2026: Initiation of pilot projects in 10 smart cities for urban affordable housing under the Smart City Housing Scheme

- Fiscal 2027: Comprehensive review of progress, mid‑term evaluation, and adjustment of targets based on performance data

A centralized dashboard will be deployed to provide real‑time visibility into beneficiary enrolment, construction progress, and fund absorption. The platform will integrate data feeds from the PMAY Management Information System, state panchayat portals, and private‑sector partners, enabling transparent monitoring and rapid corrective action. Independent audit agencies will also conduct periodic third‑party assessments to validate the data and ensure compliance with budgetary provisions.

Expected Socio‑Economic Impact

Stakeholders anticipate a range of positive socio‑economic outcomes from the expanded budgetary support. Firstly, the reduction in homelessness, particularly in tribal and rural regions, is expected to improve health and education indicators, as secure housing is closely linked to better nutrition and school attendance. Secondly, the construction boom will act as a catalyst for ancillary industries—cement, steel, bricks, and building materials—potentially contributing an additional 1.5 % to GDP growth through increased consumption and investment. Thirdly, the expanded credit guarantees and subsidies are projected to enhance financial inclusion, granting millions of low‑income families access to formal banking services and formal housing assets.

Long‑term benefits also include social upliftment through tenure security, which research from the World Bank shows can reduce poverty rates by up to 5 % in vulnerable communities. By integrating affordable housing with infrastructure upgrades and livelihood programmes, the government aims to create a holistic ecosystem that not only provides roofs over heads but also empowers beneficiaries with pathways to economic stability.

Stay updated with the latest Yojana schemes and government initiatives for better awareness and eligibility. For personalized guidance on accessing these benefits, reach out to us.